IAS 24 Related Party Disclosures

Tax Guide: IAS 24 Related Party Disclosures

SCOPE

- Identify related party relationships, transactions, outstanding balances and commitments

- Identify when disclosures about these transactions are required and what those disclosures will be

IDENTIFYING RELATED PARTIES

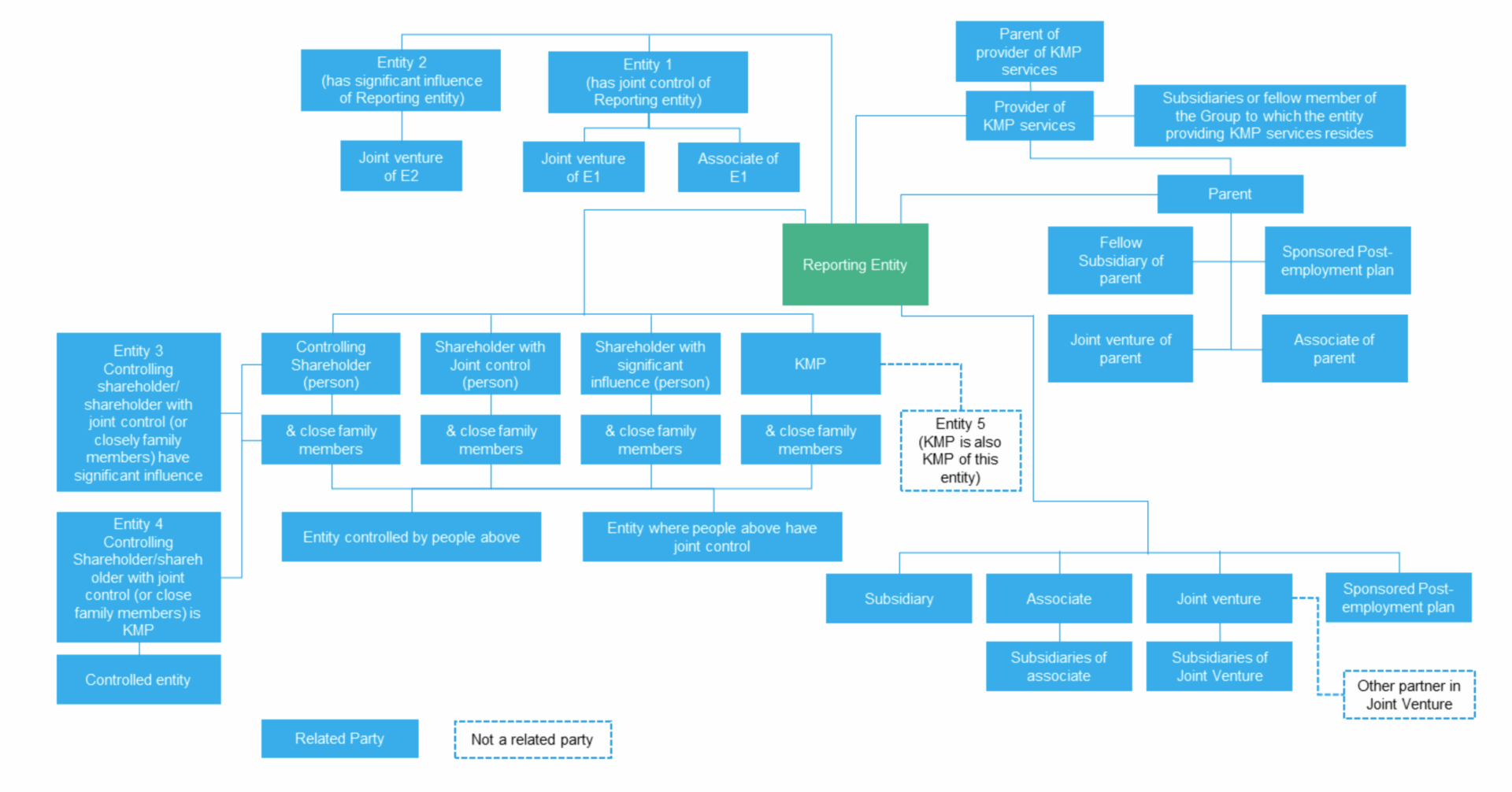

A related party is a person or entity that is related to the entities that is preparing the financial statements. See page 2 for a diagram to assist in identifying related parties. In identifying related parties the following are key terms:

Key management personnel (KMP)

Those persons who have authority and are responsible for planning, directing and controlling the activities of the entity including any director of that entity.

Close family members

These include spouses, children and other dependants, that may be expected to influence or be influenced by the relevant person in their dealings with the entity

GOVERNMENT ENTITIES

Special rules apply to government-related entities. Such entities are not required to provide detailed information regarding all the transactions with related entities and can instead provide details around the name of the government and its relationship with the entity and sufficient details so users can understand the effects of related party transactions on the entity.

DISCLOSURES

Key management personnel compensation

Entities must disclose KMP compensation calculated in accordance with IAS 19 Employee Benefits and IFRS 2 Share-based payments paid by or on behalf of the entity including the totals for:

- Short-term employee benefits

- Post-employment benefits

- Other long-term benefits

- Termination benefits

- Share-based payments

Other related party disclosures

Disclosures should be provided in aggregate for each of the following groups of related parties

- The parent

- Entities with joint control/ significant influence over the entity

- Subsidiaries

- Associates

- Joint ventures

- KMP

- Other related parties

For each of those groups identified above, entities should disclose

- Amount of transactions

- Balance outstanding at year-end, including commitments and the associated terms and conditions

- Any guaranteed given or received

Doubtful debts recognised in relation to these balances and the related doubtful debts expense recognised during the period.

IDENTIFICATION OF RELATED PARTIES

The following outline the key related party relationships identified in IAS 24

CONTACTS

| BOAZ DAHARI Moore Israel [email protected] | KRISTEN HAINES Moore Australia [email protected] | TAN KEI HUI Moore Malaysia [email protected] |

| CHRISOF STEUBE Moore Singapore [email protected] | NEES DE VOS Moore DRV [email protected] | TESSA PARK Moore Kingston Smith [email protected] |

| EMILY KY CHAN Moore CPA Limited [email protected] | PAUL CALLAGHAN Moore Oman [email protected] | THEODOSIOS DELYANNIS Moore Greece [email protected] |

| IRINA HUGHES Johnston Carmichael [email protected] | SAHEEL ABDULHAMID Moore JVB LLP [email protected] |

MOORE IFRS in Brief is prepared by Moore Global Network Limited (“Moore Global”) and is intended for general guidance only. The use of this document is no substitute for reading the requirements in the IFRS® Accounting Standards issued by the International Accounting Standards Board (IASB). This document reflects requirements applicable as at the date of publication, any amendments applicable after the date of issuance, to the IFRS® Accounting Standards have not been reflected. Professional advice should be taken before applying the content of this publication to your particular circumstances. While Moore Global endeavors to ensure that the information in this publication is correct, no responsibility for loss to any person acting or refraining from action as a result of using any such information can be accepted Moore Global.