IAS 33 Earnings Per Share

Tax Guide: IAS 33 Earnings Per Share

SCOPE

IAS 33 Applies to applies to both consolidated financial statements and separate or individual statements (where relevant) of an entity where an entity has either:

- publicly traded debt or equity instruments; or

- files or is in the process of filing financial statements with a regulatory body for the purpose of issuing instruments in a public market.

Where an entity presents both consolidated and separate financial statements, the disclosures required by this standard need only to be provided based on the consolidated information.

BASIC EARNINGS PER SHARE

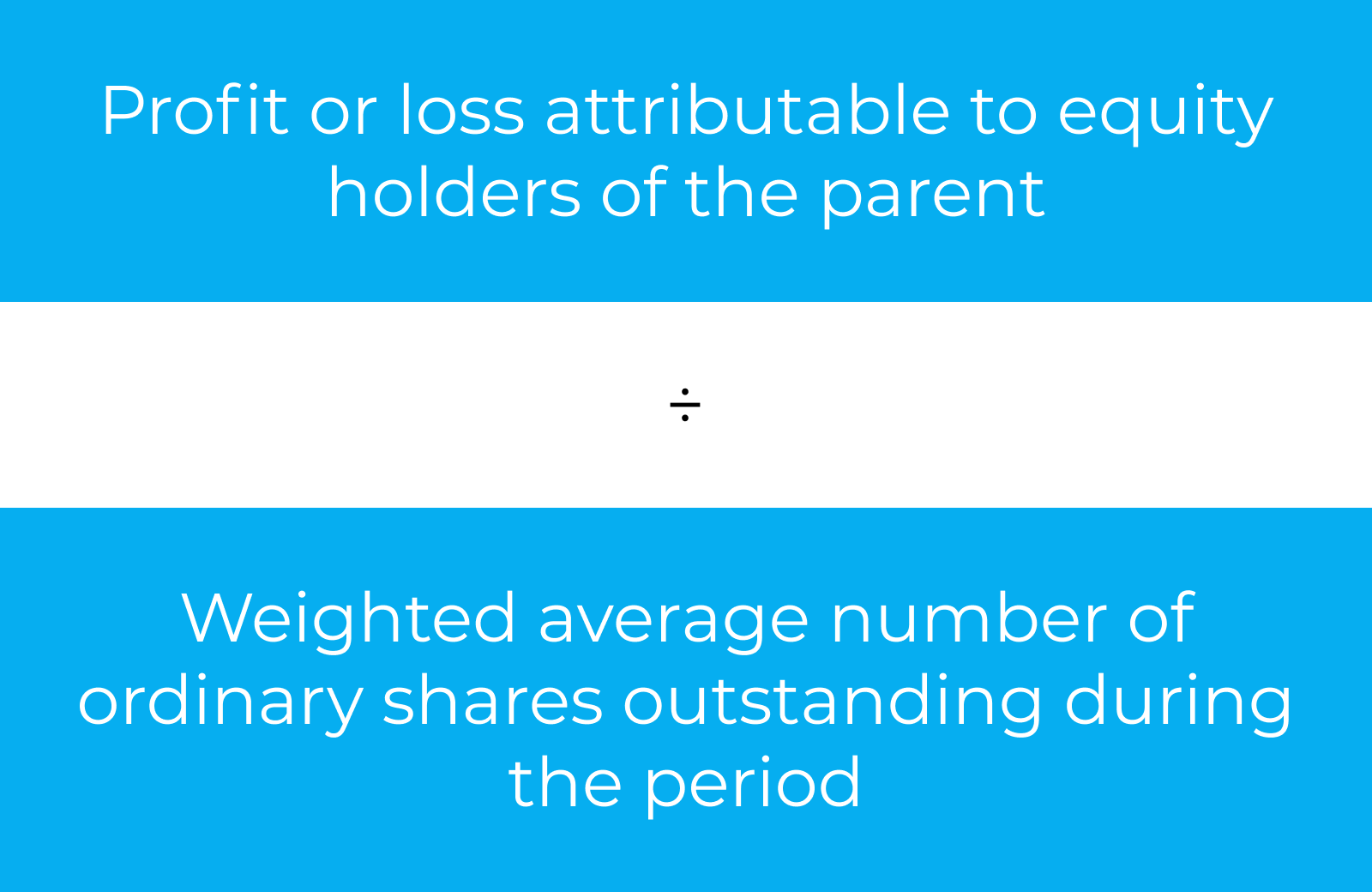

Basic Earnings Per Share (EPS) is calculated as:

Profit or loss

EPS should be presented for both

- Profit or loss attributable to equity holders of the parent

- Profit or loss from continuing operations attributable to equity holders of the parent

The profit or loss amounts should be adjusted for the after tax amounts of distributions paid to preference shares or other instruments classified as equity other than ordinary shares.

Weighted average number of ordinary shares

This is the weighted average number of ordinary shares outstanding throughout the period, with shares weighted by the number of days that they have been outstanding during the period, to reflect the impact of shares issued or bought back during the year.

Ordinary shares outstanding should also be adjusted for other events that impact the number of shares outstanding including:

- share splits

- share consolidations

- bonus share issues; or

- dividend reinvestment plans.

Such changes should be adjusted retrospectively for the comparative period as well. Including if they arise after the end of the period but before the financial statements are issued.

DILUTED EARNINGS PER SHARE

Diluted EPS is calculated by adjusting. both the profit and loss and weighted average number of ordinary shares outstanding for the impact of all dilutive potential ordinary shares.

Diluted EPS should be presented for both

- Profit or loss attributable to equity holders of the parent

- Profit or loss from continuing operations attributable to equity holders of the parent

Potential ordinary shares are only dilutive when the conversion to ordinary shares decreases the EPS from continuing operations.

Profit or loss

The Profit or loss used to determine the basic EPS is adjusted by the after tax effects of dividends, interest or other changes in income or expense that would arise from the dilutive potential shares that would not arise if the dilutive potential shares were ordinary shares.

Weighted average number of ordinary shares

This is the weighted number of ordinary shares used to calculate basic EPS

Plus

The weighted average number of shares that would be issued if all dilutive potential shares were converted into ordinary shares. Potential dilutive shares are considered to be converted at the beginning of the period if outstanding for the whole period.

Specific potential dilutive shares are considered as follows:

- Options and warrants

Assume the theoretical proceeds from exercise of the options or warrants are used to purchase ordinary shares at the weighted average market price. The difference between the number of shares that would be issued on exercise of the options or warrants, and the number that could be purchased at the weighted average market price, are considered to be issued for nil consideration - Purchased options

These are never included in a diluted EPS calculation as they will always be anti-dilutive when they are in the money. - Written put options

These are only included if they are ‘in the money’ during the period. If they are in the money, the impact is calculated consistently with the requirements above. - Contingently issuable shares

For contingently issuable shares where the contingency period has not yet been satisfied, the number of potential ordinary shares is determined as the number of shares that would be issuable if the end of the period was the end of the contingency period - Contracts that may be settled in cash or shares

Where the settlement choice is at the entity’s discretion, they are presumed to be settled in shares and the potential shares are included if dilutive.

Where the settlement choice is at the holder’s discretion, cash or equity settlement is included based on whichever is more dilutive.

DISCLOSURES

Basic EPS and diluted EPS and basic EPS and diluted EPS relating to continuing operations shall be presented in the statement of comprehensive income.

Basic and diluted EPS related to discontinued operations may be presented either in the statement of comprehensive income or in the notes.

Disclosures are also required to provide information around the earnings and ordinary shares information that is used and any potential ordinary shares that have been excluded as they are anti-dilutive.

CONTACTS

| BOAZ DAHARI Moore Israel [email protected] | KRISTEN HAINES Moore Australia [email protected] | TAN KEI HUI Moore Malaysia [email protected] |

| CHRISOF STEUBE Moore Singapore [email protected] | NEES DE VOS Moore DRV [email protected] | TESSA PARK Moore Kingston Smith [email protected] |

| EMILY KY CHAN Moore CPA Limited [email protected] | PAUL CALLAGHAN Moore Oman [email protected] | THEODOSIOS DELYANNIS Moore Greece [email protected] |

| IRINA HUGHES Johnston Carmichael [email protected] | SAHEEL ABDULHAMID Moore JVB LLP [email protected] |

MOORE IFRS in Brief is prepared by Moore Global Network Limited (“Moore Global”) and is intended for general guidance only. The use of this document is no substitute for reading the requirements in the IFRS® Accounting Standards issued by the International Accounting Standards Board (IASB). This document reflects requirements applicable as at the date of publication, any amendments applicable after the date of issuance, to the IFRS® Accounting Standards have not been reflected. Professional advice should be taken before applying the content of this publication to your particular circumstances. While Moore Global endeavors to ensure that the information in this publication is correct, no responsibility for loss to any person acting or refraining from action as a result of using any such information can be accepted Moore Global.