IFRS 15 Revenue from Contracts with Customers

Tax Guide: IFRS 15 Revenue from Contracts with Customers

SCOPE

IFRS 15 applies to all contracts with customers, except for those in the scope of other standards listed below. A customer is a party that has contracted with the entity to obtain goods or services that are outputs of the entity’s ordinary operations in exchange for consideration. Contracts in the scope of other standards include contracts in the scope of

- IFRS 16 Leases

- IFRS 17 Insurance contracts

- IFRS 9 Financial instruments

Also excluded are non-monetary trades between similar entities to facilitate sales with a customer. Contracts may be partially in the scope of IFRS 15 and partially in the scope of another standard.

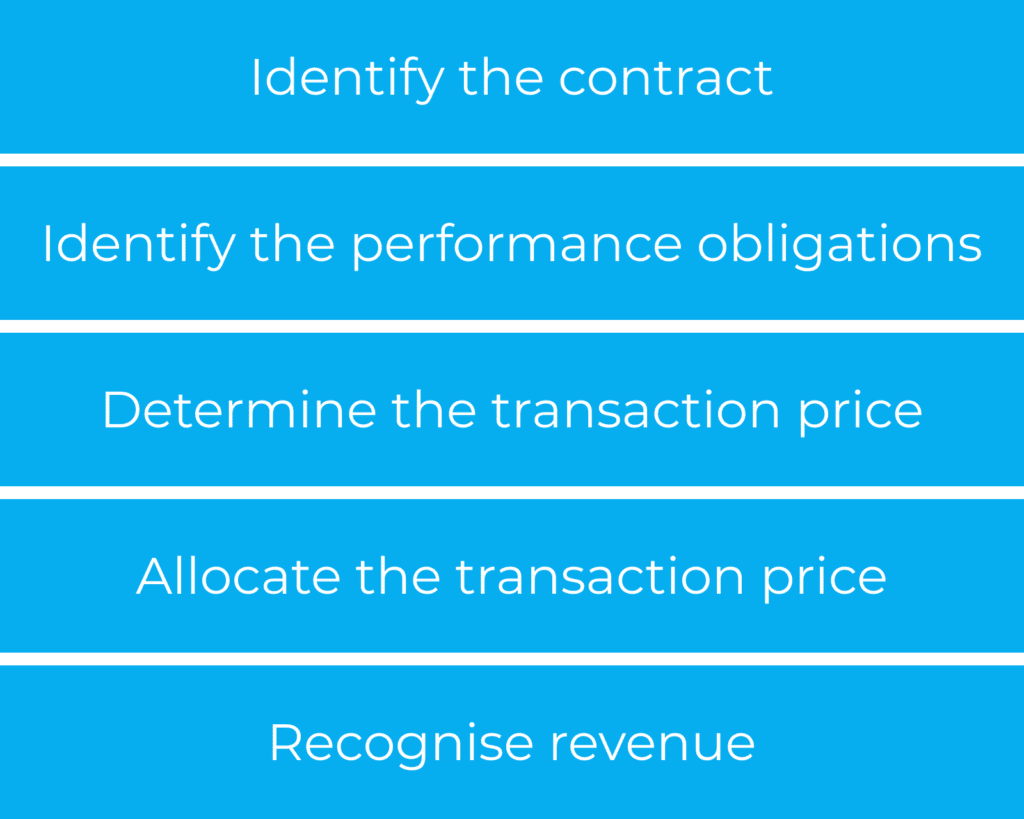

REVENUE RECOGNITION MODEL

Revenue is recognised applying the following five step model:

STEP 1: IDENTIFY THE CONTRACT

A contract with a customer exists if:

- rights to products or services and payment terms can be identified;

- it is approved and the parties are committed to their obligations;

- collection of consideration is considered probable; and

- it has commercial substance.

STEP 2: IDENTIFY THE PERFORMANCE OBLIGATIONS

A performance obligation is a promise in a contract to the customer that has the following features:

- Capable of being distinct

A promise is capable of being distinct if the customer can benefit from it on its own or together with other resources that are readily available to it. - Distinct within the context of the contract

Promises are not separately identifiable from other promises in the contract and should be combined into a single performance obligation if:

- The entity provides a significant service of integration between promises

- One promise significantly modifies other promises in the contract

- The promises are so highly dependent or interrelated they couldn’t be provided separately

Performance obligations may also be a series where each individual performance obligation is satisfied overtime (see step 5 below) and the same method of progress would be applied to each individual performance obligation.

STEP 3: DETERMINE THE TRANSACTION PRICE

The transaction price is the amount of consideration to which the entity expects to be entitled to in exchange for transferring the promised goods or services to the customer, excluding amounts collected on behalf of third parties.

In addition to fixed cash consideration, the transaction price may include the following:

Variable consideration

If a contract contains consideration that is variable the amount of consideration should be estimated using either:

- Expected value (probability weighted)

- Most likely amount

The estimate of variable consideration should be constrained at an amount for which it is highly probable that a significant reversal would not occur.

This estimate should be updated each reporting date.

Non-cash consideration

Non-cash consideration should be measured at its fair value.

Significant financing components

Revenue is adjusted for the time value of money if the affect is significant. Where consideration is received more than 12 months before or after the performance obligation is delivered there is an indication of a significant financing element. Revenue is determined as the cash equivalent selling price, and the difference is recognised as interest income or expense.

Consideration payable to the customer

If an entity pays consideration back to the customer, and it is not for a separate purchase, the amount paid is recognised as a reduction in the transaction price.

STEP 4: ALLOCATE THE TRANSACTION PRICE

Consideration should be allocated to each performance obligation on the basis of their relative stand-alone selling price. The stand-alone selling price shall be based on observable prices or if they are not available they can be estimated using:

- An adjusted market approach

- Cost plus margin

Allocating consideration on a residual basis is only permitted in limited circumstances where the selling price is highly variable.

Discounts and variable consideration can be allocated to specific performance obligations or groups of performance obligations if specific conditions are met.

STEP 5: RECOGNISE REVENUE

Revenue is recognised overtime if any of the following conditions are met:

- Customer simultaneously receives and consumes the benefits as the entity performs

- Customer controls the asset as the entity creates or enhances it

- The entity’s performance does not create an asset for which the seller has an alternative use and there is a right to payment for performance to date

Otherwise, revenue is recognised at a point in time.

Revenue should be recognised at the point the customer obtains control of the performance obligation. The customer has control if it has the ability to direct the use of, and obtain substantially all the remaining benefits from the good or service.

OTHER CONSIDERATIONS

Costs to obtain contracts

Costs to obtain a contract that would be incurred regardless of whether the contract was won or not must be expensed as incurred. Costs may only be capitalised if they are incremental costs to winning the contract and that are expected to be recoverable.

Costs to fulfil contracts

When considering capitalising costs relating to fulfilling a customer contract, entities must first consider whether the costs are dealt with in the scope of any other standard (e.g. IAS 2 Inventories, IAS 16 Property, Plant and Equipment, or IAS 38 Intangible Assets). If they are not, the costs can only be capitalised if they directly relate to existing contracts or specific anticipated contracts, generate or enhance resources that will be used to fulfil performance obligations in the future and are expected to be recoverable. You cannot capitalise costs relating to performance obligations satisfied over time they must be expensed as incurred.

Licences of intellectual property

Where licences of intellectual property are a separate performance obligation and all the following conditions are met, it is considered a right to access the entity’s intellectual property and recognised over time:

- The entity expects to undertake activities that will impact the intellectual property

- The right directly exposes the customer to the effects of the entity’s activities

- The activities undertaken do not result in the transfer of additional goods or services

If any of the above do not apply, then it is a right to use the entity’s intellectual property and revenue is recognised at a point in time.

Special rules also apply for sale and usage royalties relating to the use of intellectual property.

Principal v Agent

An entity is the principal in providing a good or service if it has control of the good or service before it is provided to the customer. Otherwise, it is an agent. Where control is not clear, the following indicator may assist in the assessment of principal or agent. Does the entity have:

- Primary responsibility for providing the specified good or service

- Inventory risk

- Discretion in establishing prices

DISCLOSURES

Extensive disclosures are required about the terms and performance obligations in contracts with customers, most significantly for long-term contracts. Disclosures include information about each revenue stream, disaggregation of revenue, reconciliation of movements in contract liabilities and contract assets as well as expected timing of contracted transaction price as revenue in future periods.

CONTACTS

| BOAZ DAHARI Moore Israel [email protected] | KRISTEN HAINES Moore Australia [email protected] | TAN KEI HUI Moore Malaysia [email protected] |

| CHRISOF STEUBE Moore Singapore [email protected] | NEES DE VOS Moore DRV [email protected] | TESSA PARK Moore Kingston Smith [email protected] |

| EMILY KY CHAN Moore CPA Limited [email protected] | PAUL CALLAGHAN Moore Oman [email protected] | THEODOSIOS DELYANNIS Moore Greece [email protected] |

| IRINA HUGHES Johnston Carmichael [email protected] | SAHEEL ABDULHAMID Moore JVB LLP [email protected] |

MOORE IFRS in Brief is prepared by Moore Global Network Limited (“Moore Global”) and is intended for general guidance only. The use of this document is no substitute for reading the requirements in the IFRS® Accounting Standards issued by the International Accounting Standards Board (IASB). This document reflects requirements applicable as at the date of publication, any amendments applicable after the date of issuance, to the IFRS® Accounting Standards have not been reflected. Professional advice should be taken before applying the content of this publication to your particular circumstances. While Moore Global endeavors to ensure that the information in this publication is correct, no responsibility for loss to any person acting or refraining from action as a result of using any such information can be accepted Moore Global.