IFRS 16 Leases

Tax Guide: IFRS 16 Leases

SCOPE

IFRS 16 applies to all leases including subleases, except for:

- leases to explore for or use minerals, oil, natural gas and similar non-regenerative resources;

- leases of biological assets within the scope of IAS 41 Agriculture held by a lessee;

- service concession arrangements within the scope of IFRIC 12, Service Concession Arrangements;

- licences of intellectual property granted by a lessor within the scope of IFRS 15, Revenue from Contracts with Customers; and

- rights held by a lessee under licensing agreements for items such as films, videos, plays, manuscripts, patents and copyrights within the scope of IAS 38, Intangible Assets (a lessee can elect to apply IFRS 16 to leases of intangible assets, other than those items listed above).

IDENTIFYING A LEASE

A contract is, or contains, a lease if it conveys the right to control the use of an identified asset for a period of time in exchange for consideration.

Control is conveyed when the customer has the right to direct the identified asset’s use and to obtain substantially its economic benefits from that use.

LEASE TERM

Leases must be accounted for over their lease term. The lease term includes the non-cancellable period of the lease plus:

- Periods covered by an extension option if reasonably certain to extend

- Periods covered by a termination option is reasonably certain not to terminate.

LESSEE ACCOUNTING

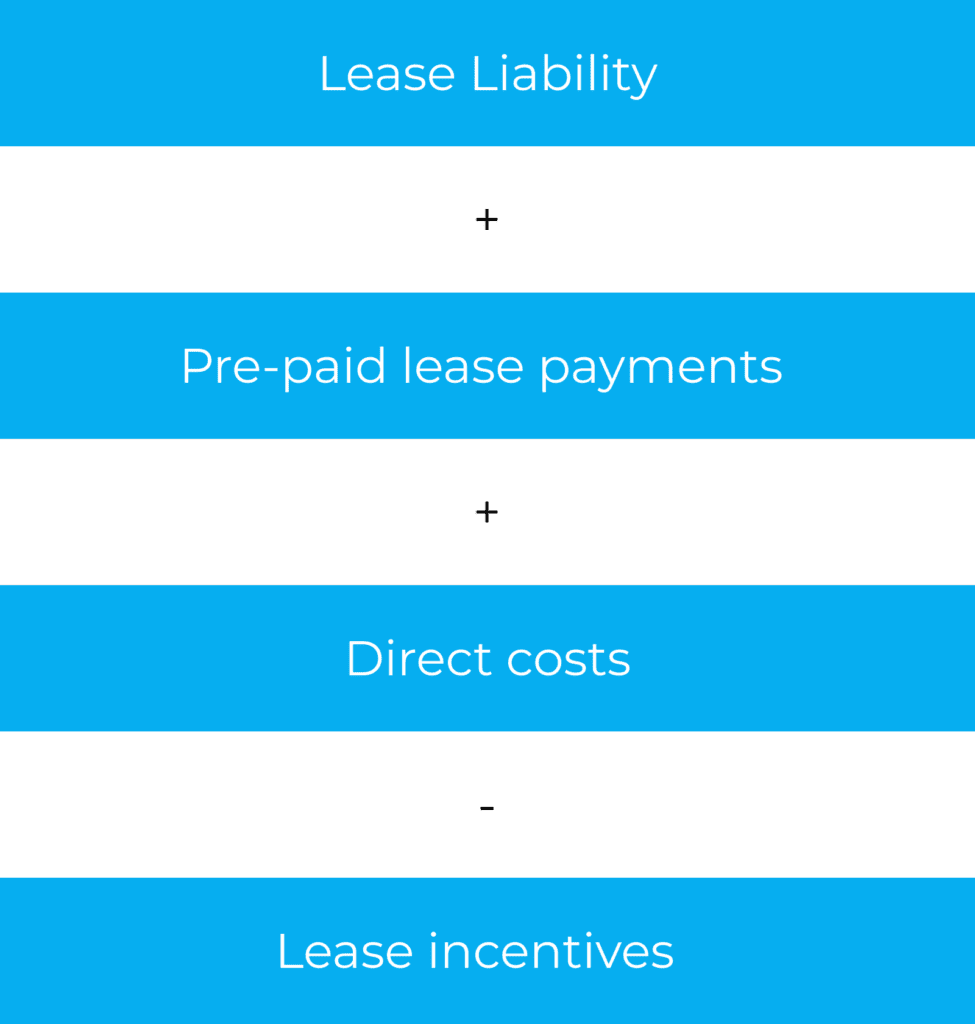

A lessee recognises a right-of-use asset and a lease liability. The right-of-use asset is measured initially at:

The lease liability is measured initially at the present value of the lease payments payable over the lease term, discounted at the rate implicit in the lease if that can be readily determined. If that rate cannot be readily determined, the lessee uses its incremental borrowing rate.

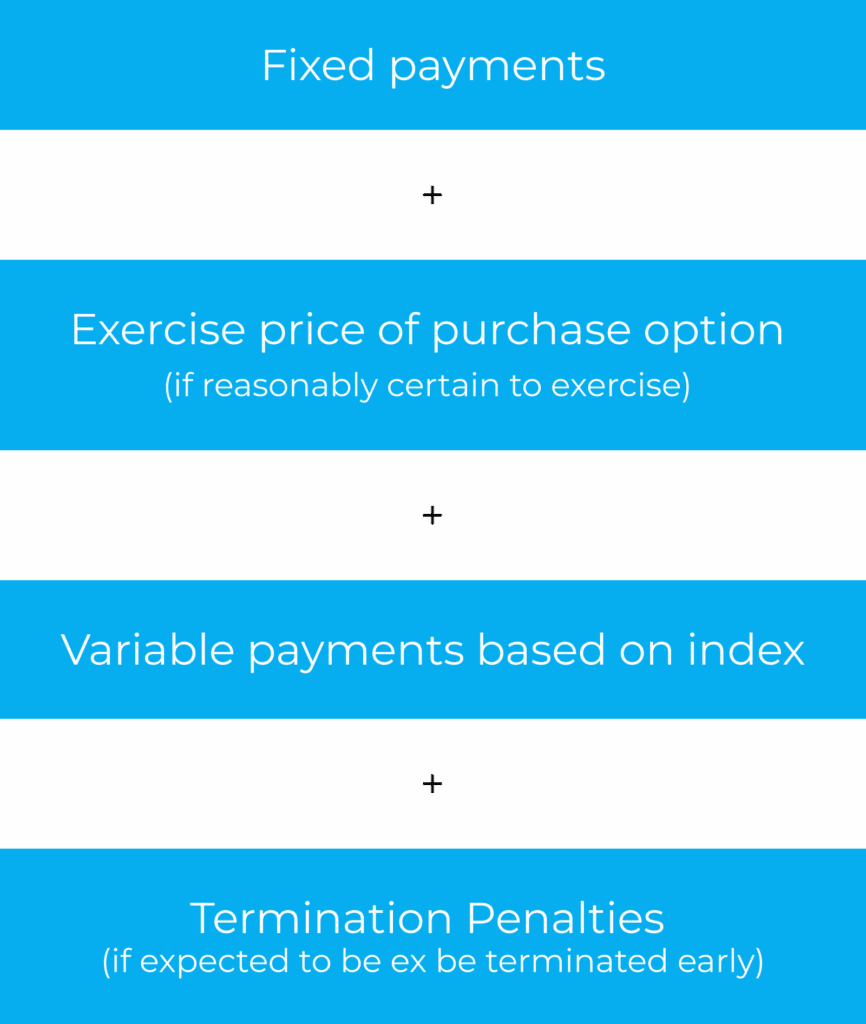

The lease payments included in the measurement of the lease liability are:

When lease payments are made, they are allocated between interest expense and repayment of the lease liability.

Variable lease payments

Variable lease payments not included in the lease liability, are recognised as an expense when payable.

Low value and short-term leases

Entities can elect not to recognise right-of-use assets and lease liabilities when:

- the lease term is 12 months or less; or

- when the underlying asset has a low value when new (e.g. < $5000 USD).

This election can be made on a lease-by-lease basis. If applied, the lease payments are recognised on a basis that represents the pattern of the lessee’s benefit (typically straight-line over the lease term).

LESSOR ACCOUNTING

Lessors classify each lease as an operating lease or a finance lease. Classification is made at the inception of the lease and is reassessed only if there is a lease modification.

A lease is classified as a finance lease if it transfers substantially all the risks and rewards incidental to ownership of an underlying asset. Otherwise, a lease is classified as an operating lease.

A lessor recognises assets held under a finance lease as a finance lease receivable at an amount equal to the net investment in the lease upon lease commencement.

Lessors recognise finance income on their net investment in lease (in case of finance leases) and operating lease income (on a systematic basis) in case of operating leases.

SALE-AND-LEASEBACK

For sale and leaseback transactions, the seller is required to determine whether the transfer of an asset is a sale by applying the requirements of IFRS 15 Revenue from Contracts with Customers to determine if control has transferred.

In the books of the lessee

- If the transfer is a sale

The seller measures the right-of-use asset at the proportion of the previous carrying amount that relates to the right of use retained. As a result, the seller only recognises the amount of gain or loss that relates to the rights transferred to the buyer. Adjustments required if sale is not at fair value or lease payments are not at market rates. - If the transfer is not a sale

This is accounted for as a financing transaction. The asset continues to be recognised and a financial liability is recognised equal to the proceeds transferred. The financial liability is accounted for in accordance with IFRS 9 Financial Instruments.

In the books of the lessor

- If the transfer is a sale

Account for the purchase of the asset by applying the applicable IFRS. Account for the lease under the normal lessor accounting requirements IFRS 16. - If the transfer is not a sale

Do not recognise the asset transferred and recognise a financial asset equal to the transfer proceeds. The financial asset is accounted for in accordance with IFRS 9.

SUB-LEASES

In a sub-lease transaction, the intermediate lessor accounts for the head lease and the sub-lease as two separate contracts. An intermediate lessor classifies a sub-lease as either an operating or finance lease with reference to the right-of-use asset arising from the head lease, and not the underlying asset.

LEASE MODIFICATIONS

When there is a change to the scope of, or consideration for, a lease that was not part of the original terms and conditions of the lease, both the lessor and lessee should apply the detailed guidance, in the standard, on lease modifications.

For lessees this may require adjustments to the lease liability and potentially the right-of-use asset or directly in profit or loss.

For lessors, the impacts on modifications of finance leases is dependent on whether it can be considered a separate lease not.

DISCLOSURES

IFRS 16 requires qualitative and quantitative information about their leasing activities. for both lessors and lessees. Including extensive details about future exposures to lease payments for the lessee.

CONTACTS

| BOAZ DAHARI Moore Israel [email protected] | KRISTEN HAINES Moore Australia [email protected] | TAN KEI HUI Moore Malaysia [email protected] |

| CHRISOF STEUBE Moore Singapore [email protected] | NEES DE VOS Moore DRV [email protected] | TESSA PARK Moore Kingston Smith [email protected] |

| EMILY KY CHAN Moore CPA Limited [email protected] | PAUL CALLAGHAN Moore Oman [email protected] | THEODOSIOS DELYANNIS Moore Greece [email protected] |

| IRINA HUGHES Johnston Carmichael [email protected] | SAHEEL ABDULHAMID Moore JVB LLP [email protected] |

MOORE IFRS in Brief is prepared by Moore Global Network Limited (“Moore Global”) and is intended for general guidance only. The use of this document is no substitute for reading the requirements in the IFRS® Accounting Standards issued by the International Accounting Standards Board (IASB). This document reflects requirements applicable as at the date of publication, any amendments applicable after the date of issuance, to the IFRS® Accounting Standards have not been reflected. Professional advice should be taken before applying the content of this publication to your particular circumstances. While Moore Global endeavors to ensure that the information in this publication is correct, no responsibility for loss to any person acting or refraining from action as a result of using any such information can be accepted Moore Global.