IFRS 3 Business Combinations

Tax Guide: IFRS 3 Business Combinations

SCOPE

IFRS 3 covers the following key areas:

- identifying a business combination;

- recognising and measuring identifiable assets and liabilities and any non-controlling interest arising on a business combination;

- recognising and measuring goodwill or gain from a bargain purchase arising on the combination.

IDENTIFYING A BUSINESS COMBINATION

A business combination occurs when an entity obtains control over a business.

A business is defined as an integrated set of activities and assets that is capable of being conducted and managed for the purpose of generating returns. A business consists of three elements as follows:

Alternatively, management may conduct an optional concentration. If substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or group of similar identifiable assets, it is considered not a business.

If a business combination has occurred, the entity applies the acquisition method set out in IFRS 3 to account for it. . Otherwise, it is accounted for as an asset acquisition, outside the scope of IFRS 3.

If an entity has undertaken a business combination under common control, it is outside the scope of IFRS 3. Various methods of accounting for such transactions are used in practice.

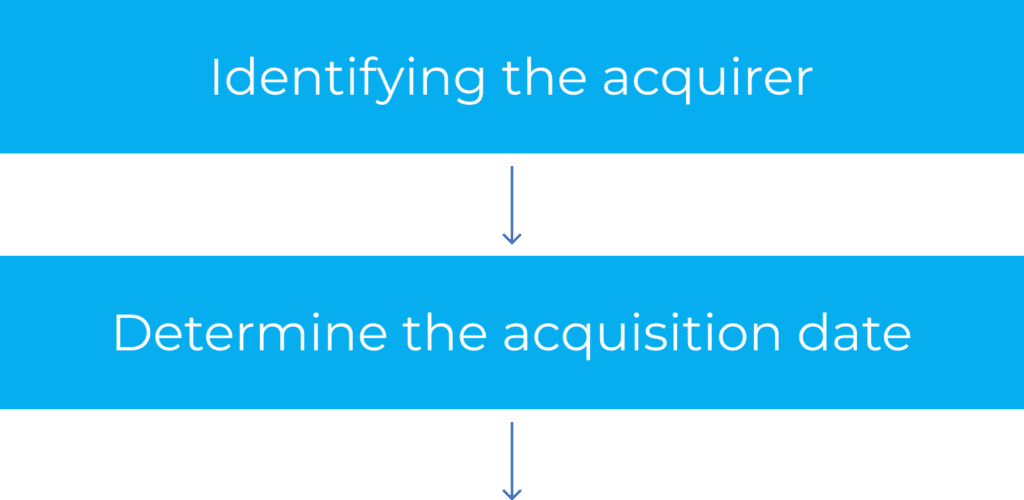

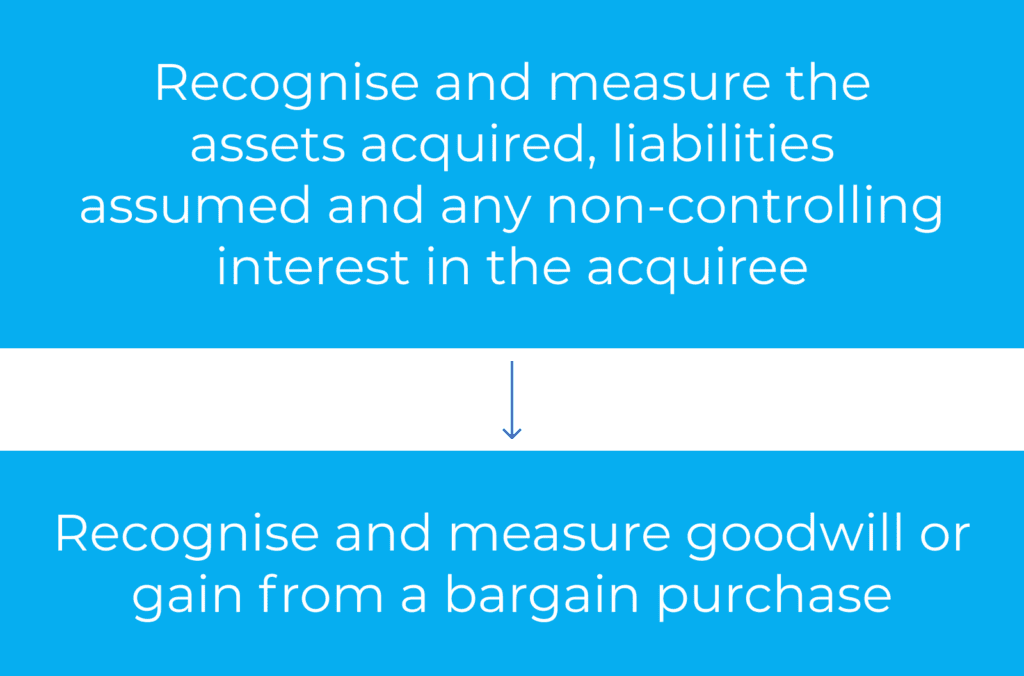

ACQUISITION METHOD

Applying the acquisition method involves

The following steps:

Identifying the acquirer

In a business combination, the acquirer is the entity that obtains control of the acquiree. An acquirer is usually the entity that transfers cash or other assets, incurs liabilities, or issues shares, and normally the legal acquirer and the accounting acquirer are the same entity. However, in a reverse acquisition, the party which issues shares is the accounting acquiree under IFRS 3, even though legally it is the acquirer.

A reverse acquisition may occur when a public company issues shares to acquire a private company, and the private company obtains the majority of the shareholding in the group and also controls the board following the transaction. Judgement must be applied to assess which entity obtains effective control over the other, and whether the acquiree is a business or not.

Determine the acquisition date

The acquisition date is the date on which the acquirer obtains control of the acquiree. It is usually the date on which the acquirer legally transfers the consideration, acquires assets, and assumes liabilities of the acquiree.

In some cases, effective control can be obtained earlier, if the transaction has become unconditional prior to that date. All relevant facts and circumstances must be considered in identifying the acquisition date.

RECOGNITION AND MEASUREMENT PRINCIPLES

Assets acquired and liabilities assumed

An acquirer recognises identifiable assets acquired and liabilities assumed in a business combination which meet the definition of assets and liabilities in the Conceptual Framework.

An acquirer may recognise assets and liabilities as a result of the business combination which were not previously recognised by the acquiree, including:

- Intangible assets

recognised when they are either separable from the acquiree or arises from contractual or other legal rights. - Contingent liabilities

recognised if it is a present obligation which arises from past events and its fair value can be measured reliably. - Indemnification asset

which arises from the seller’s guarantee that the acquirer’s liability will not exceed a specified amount.

All assets acquired and liabilities assumed in a business combination, are measured at fair value on the date of acquisition, with some limited exceptions, including:

- An acquiree’s liability relating to employee benefits is measured in accordance with IAS 19 Employee Benefits rather than IFRS 3

- Deferred tax assets and liabilities are recognised on acquired assets and liabilities in accordance with IAS 12 Income taxes

Measurement period

Entities have up to 12 months from the acquisition date to finalise the valuation, although the period may be shorter and ends when the acquirer receives all the information required about facts and circumstances that existed as at acquisition date.

Non-controlling interest (NCI)

If an acquirer has not acquired 100% of the equity interest in an acquiree, the remaining equity interest attributable to other shareholders (i.e. NCI) shall be recognised at either fair value, or the NCI’s proportionate share in the recognised amount of the acquiree’s identifiable net assets.

CONSIDERATION

Potential forms of consideration include cash, other assets, ordinary or preference shares, contingent consideration etc.

An acquirer determines the amount of consideration transferred in a business combination at fair value. The fair value is calculated as the sum of the acquisition-date fair values of the assets transferred, liabilities incurred, and equity instruments issued by the acquirer.

Acquisition-related costs incurred by the acquirer (e.g. finder’s fees, legal fees etc.) are recognised as expense in the consolidated financial statements.

Contingent consideration

An obligation to pay additional consideration in future is classified as either a financial liability or equity under IAS 32 Financial Instruments: Presentation, if it meets the definition of a financial instrument. A right to the return of previously transferred consideration can only be recognised as an asset when the specified conditions are met.

Subsequently, contingent consideration is measured at fair value through profit or loss until it has been settled, unless it is classified as equity.

Where contingent consideration is contingent on vendors remaining employed by the acquired entity, this accounted for as an expense as remuneration for post combination services.

Existing interests

Where an acquirer obtains control in stages, at acquisition date any previously held interests are measured at fair value. Any resulting gain or loss from remeasurement is recognised in profit or loss.

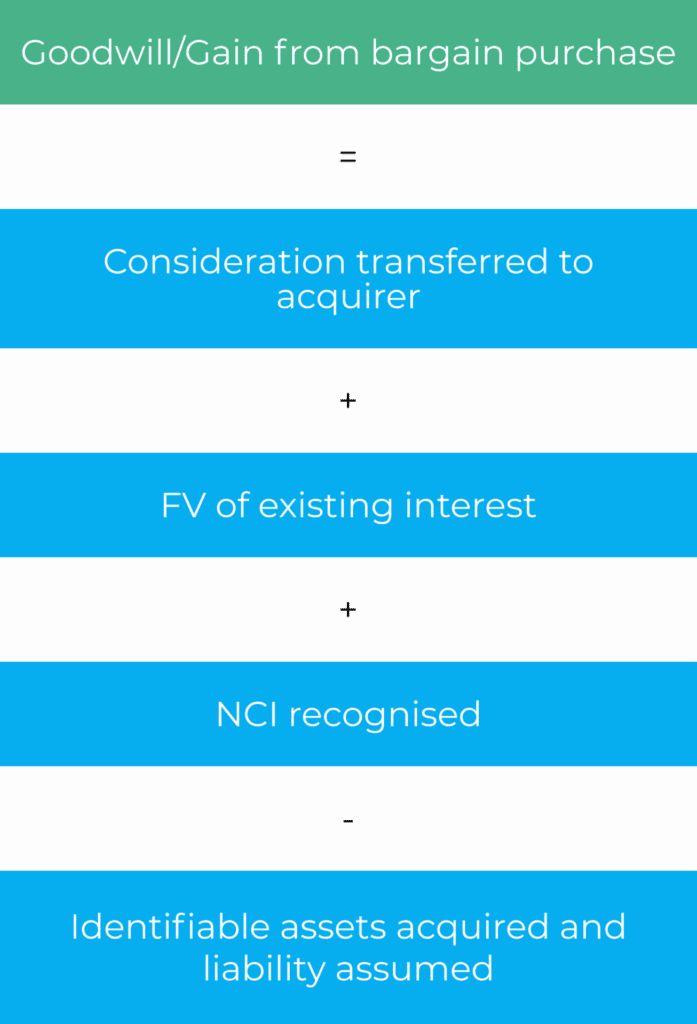

GOODWILL OR GAIN FROM A BARGAIN PURCHASE

An acquirer performs the following calculation to determine whether goodwill or a gain from a bargain purchase should be recognised at the date of acquisition:

If the resulting amount is positive (i.e. an excess), the acquirer recognises goodwill on its balance sheet.

If the resulting amount is negative, the acquirer first reassesses whether it has correctly identified all assets acquired, liabilities assumed and NCI. The acquirer would only recognise a gain from bargain purchase in its statement of profit or loss and other comprehensive income, if the reassessment does not reveal any identifiable asset, liability or NCI interest which should have been recognised and which eliminates the gain. If following this reassessment, the gain on bargain purchase is valid, it is recognised in profit or loss at the date of acquisition,

DISCLOSURE

IFRS 3 requires entities to disclose information on the nature and financial effect of each material business combination which occurs either:

- during the current reporting period; or

- after the end of the reporting period but before the financial statements are authorised for issue.

Disclosures provide details around the consideration transferred, assets and liabilities recognised as well as information regarding the purpose and synergies expected from the business combination.

CONTACTS

| BOAZ DAHARI Moore Israel [email protected] | KRISTEN HAINES Moore Australia [email protected] | TAN KEI HUI Moore Malaysia [email protected] |

| CHRISOF STEUBE Moore Singapore [email protected] | NEES DE VOS Moore DRV [email protected] | TESSA PARK Moore Kingston Smith [email protected] |

| EMILY KY CHAN Moore CPA Limited [email protected] | PAUL CALLAGHAN Moore Oman [email protected] | THEODOSIOS DELYANNIS Moore Greece [email protected] |

| IRINA HUGHES Johnston Carmichael [email protected] | SAHEEL ABDULHAMID Moore JVB LLP [email protected] |

MOORE IFRS in Brief is prepared by Moore Global Network Limited (“Moore Global”) and is intended for general guidance only. The use of this document is no substitute for reading the requirements in the IFRS® Accounting Standards issued by the International Accounting Standards Board (IASB). This document reflects requirements applicable as at the date of publication, any amendments applicable after the date of issuance, to the IFRS® Accounting Standards have not been reflected. Professional advice should be taken before applying the content of this publication to your particular circumstances. While Moore Global endeavors to ensure that the information in this publication is correct, no responsibility for loss to any person acting or refraining from action as a result of using any such information can be accepted Moore Global.